Unlocking Infinite Possibilities

MKU is highly ranked in East Africa and beyond

Virtual Tour

MKU Academics

Mount Kenya University offers affordable and competitive academic programmes.

Our SchoolsMount Kenya University has footprints in Kenya, Uganda, Rwanda, Burundi,Somaliland and Punt-Land

Student Life:Learn and have fun

MKU Ranked among top 5 best Universities in Sports by CPS ranking

CAREER INFORMATION

Latest News and Activities

Study in Kenya, Work in Germany

Latest News

Mount Kenya University (MKU) is a chartered and ISO 9001:2015 certified University committed to a broad-based, holistic and inclusive system of education. Applications are invited from qualified applicants to enroll in the following Certificate, Diploma, Bachelor’s degree, Masters and Doctorate programmes offered in flexible modes of study; Regular (full-time), part-time and Open, Distance and electronic […]

The Win Mount Kenya University Thika Main Campus emerged overall winners in the university category during the 62 edition of the Kenya Schools and Colleges National Drama and Film Festival at Embu University. The team will be presenting to the Kenyan President H.E Dr. William Ruto and other dignitaries at the Sagana State House Lodge. […]

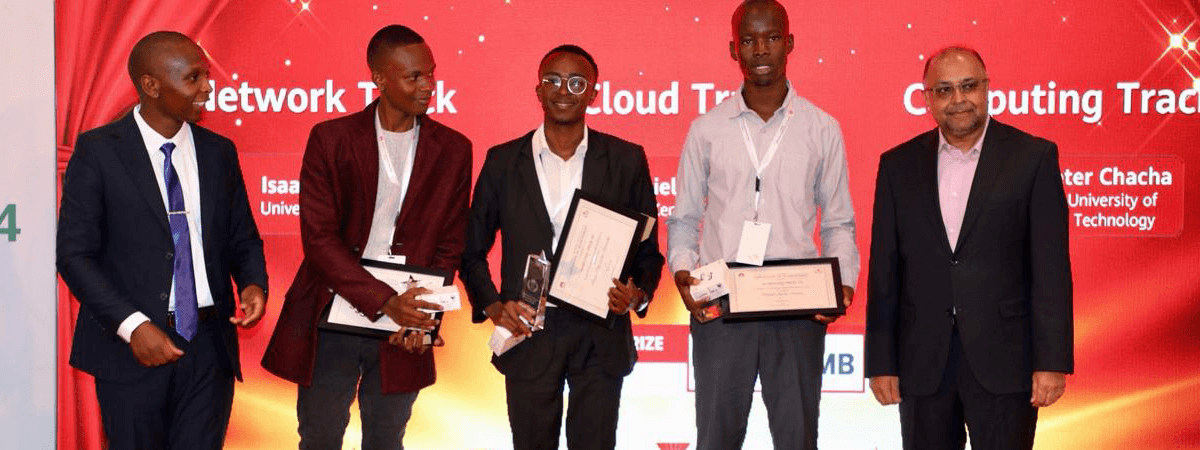

Daniel Apolo Ochola , a Bachelor Science in Information technology student at Mount Kenya University Thika Campus will be travelling to China to participate in the “Global Huawei ICT Competition” . The student will be travelling on 22nd May 2024 where they will be representing Kenya. The School of Computing and Informatic student emerged among […]

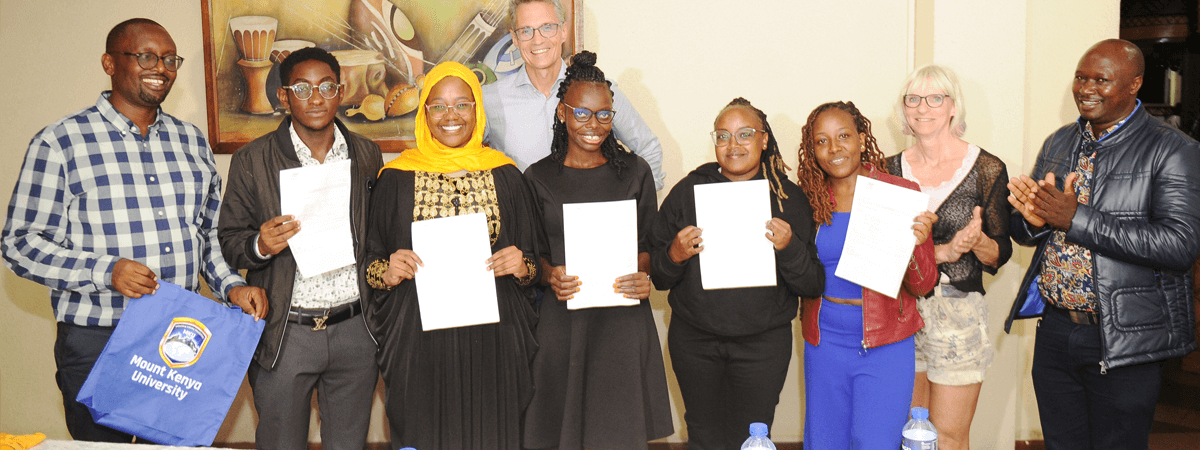

Mount Kenya University has sent the first cohort of five students to Germany to offer healthcare services in the European country. The graduates were presented with their work permits, visas, and air tickets on Saturday, all fully funded by Caritas Hospital (Germany), one of the project’s partner institutions in Germany. MKU entered into an agreement […]

Mount Kenya University and Nagaoka University of Technology (NUT) of Japan have had so far, a good relationship under their joint UNAI SDGs 9 and 10 Hubs platforms. Following this join collaboration on 21st March 2024 the University hosted Prof. Takahashi Kohske Vice President (NUT), Dr. Mami Katsumi – Chief Education Administrator (NUT) ,Dr. Yumi Yamane Director Research […]

Are you looking forward to teaching profession? Here are academic programmes that you can pursue, Mount Kenya University has an intake for Distance and Institution-Based e-Learning in the months of April, August and December, where teachers come to study during holidays and continue with distance learning when the secondary and primary students resume school. You […]

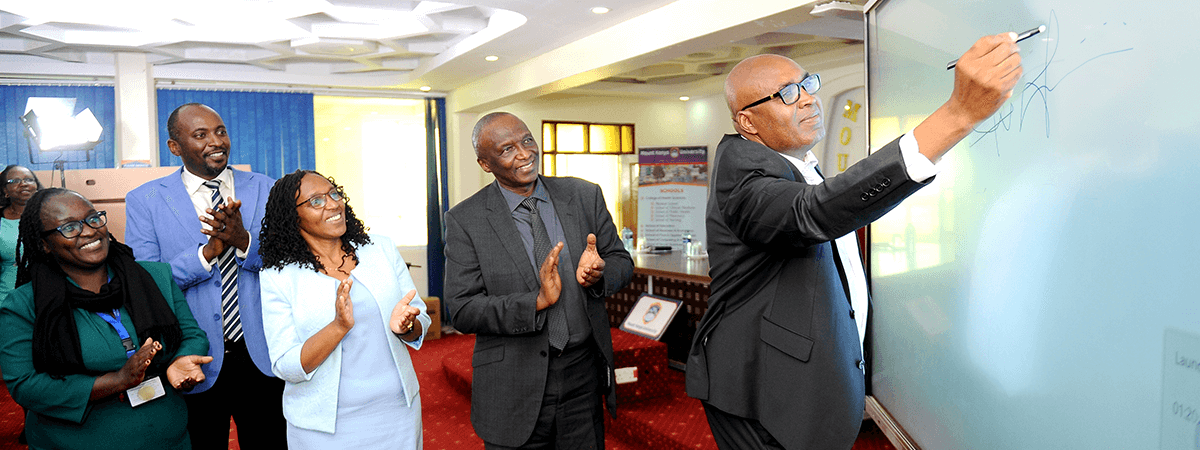

MKU acquires Interactive Displays to Enhance Technology in Teaching and Learning

In response to the growing demand for more engaging and collaborative learning environments, Mount Kenya University has integrated the use of Interactive displays and smart classrooms to enhance learning experiences and elevate the e-learning and conference experience. These interactive displays will serve as a dynamic platform for content delivery, fostering participation, and interactivity. The university […]

MKU among the top Universities in latest ranking

Mount Kenya University (MKU) is among the top six universities in the country. This is according to the latest survey by EduRank that listed the top 100 universities in Africa based on research outputs, non-academic prominence, and alumni influence. The ranking comes as more MKU faculty members submit strong proposals and attract research funding. In […]

Making the best of university life means getting the best or simply getting extra beyond the education work (academic) which is your main goal in campus. It involves a combination of academic success, personal growth, and memorable experiences. Here are some tips to help you make the most of your university experience: Remember that university […]

Welcome to Mount Kenya University where we endeavor to offer you quality and affordable education. The University has enhanced accessibility for students, staff, and stakeholders regionally and internationally through establishment of campuses and the vibrant online learning platform. Mount Kenya University is a multi-campus University with its’ main campus in Thika and other campuses in […]

Mount Kenya University school of business students have scooped second position in the recently concluded CFA Institute Research Challenge 2023/2024. MKU was competing to represent Kenya in the EMEA Sub-regional Competition. The challenge, which took place on 27th February 2023, was also happening concurrently in Kenya, Uganda, Tanzania, and Rwanda. The CFA Institute Research Challenge […]

Welcome to Mount Kenya university, home to UNAI SDG Hub 10 on Reduced Inequalities. Here at the University we have staff and students who are differently abled (PWD). The University strives to provide the best studying atmosphere for all. MKU has implemented the following measures to support PWD students: